Lance Dobson, Executive Director, Retail Intelligence, NielsenIQ New Zealand, outlines where the opportunities for convenience retailers can be best realised.

In collaboration with the New Zealand Association of Convenience Stores (NZACS), we look at the performance of the petrol and convenience (P&C) channel during, and in the wake of, the COVID-19 pandemic.

Channel performance

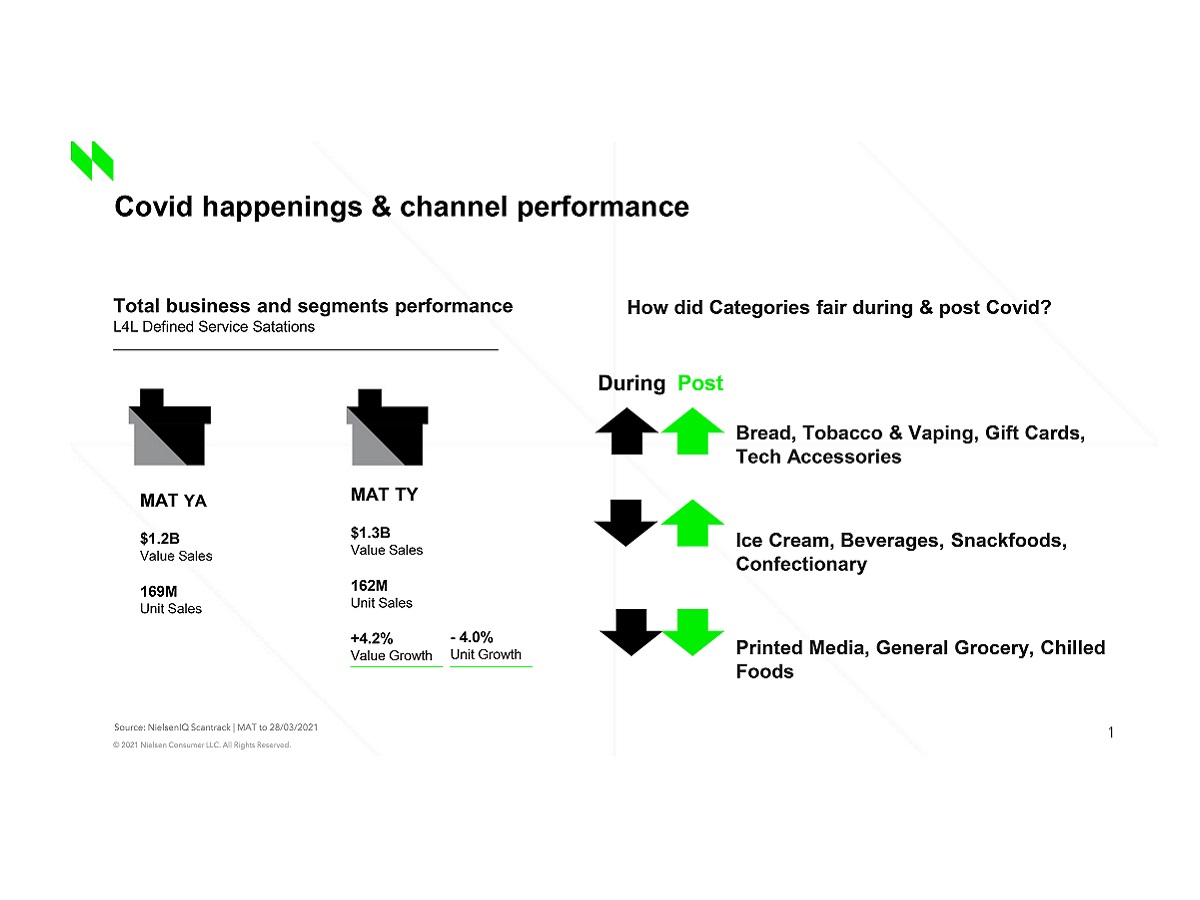

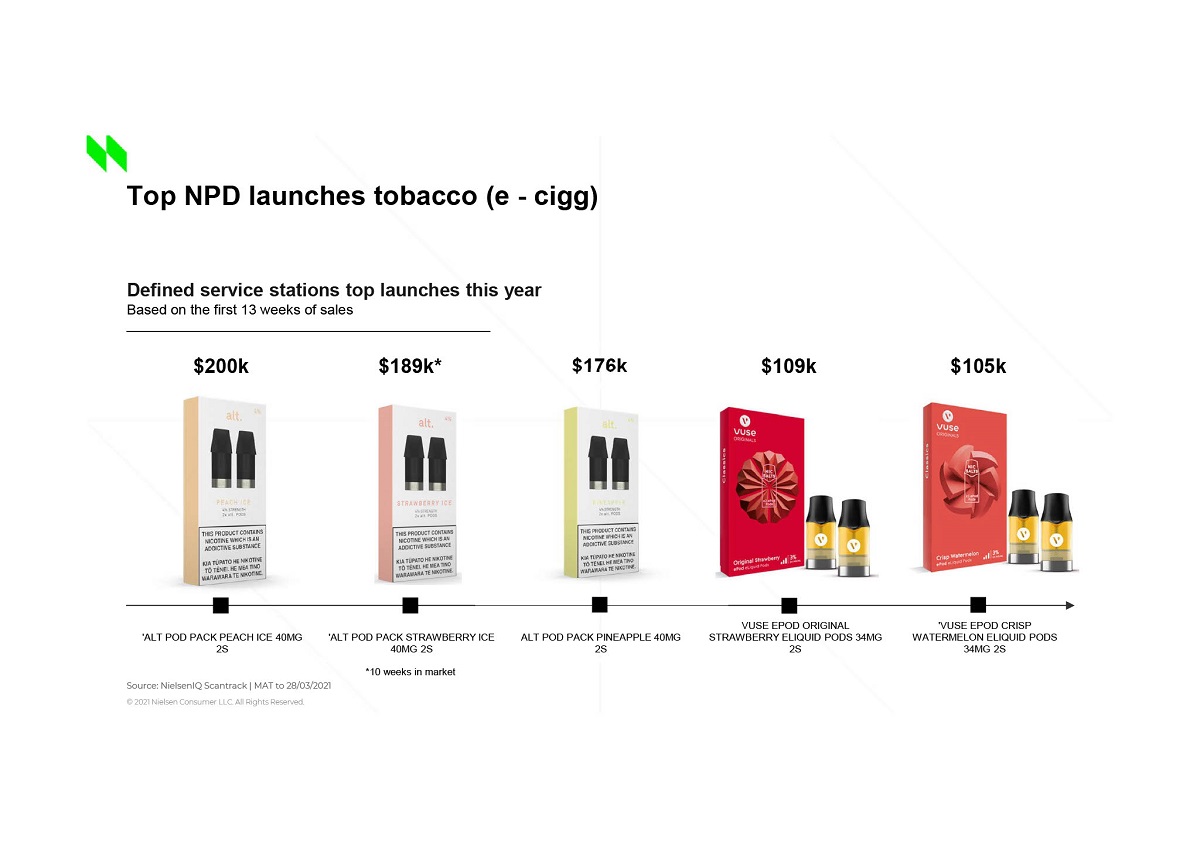

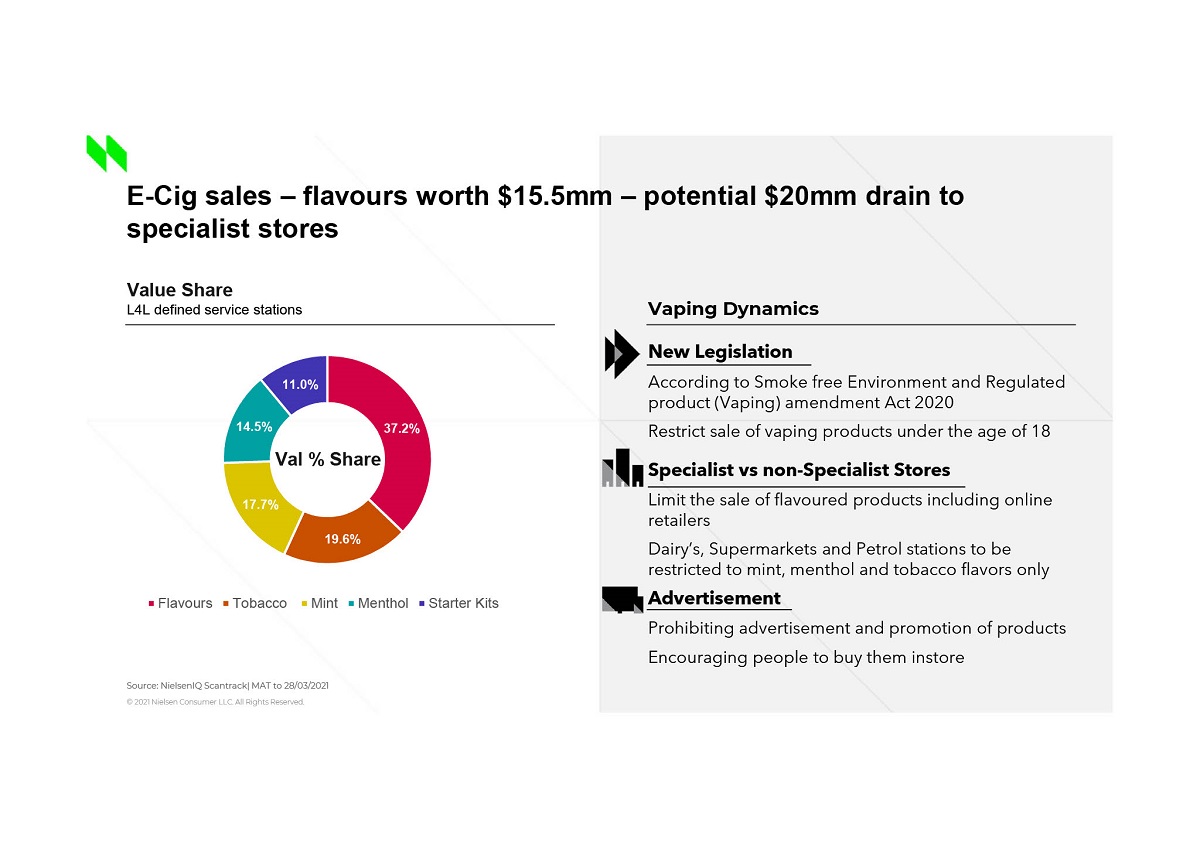

The convenience channel is seeing just over 4% value growth for the latest MAT* or $53MM vs year ago. Tobacco and vaping is still the mainstay of the channel accounting for 55% of shop sales and nearly 90% ($47MM) of the overall growth. Putting it slightly differently, for every $10 extra that is spent in the P&C channel, nine of those dollars go into the tobacco and vaping category.Flavoured vaping products make up well over 50% of the vaping segment (worth over $15.5MM), with flavoured vaping products topping the new product development charts this year. New legislation, which will restrict the sale of flavoured vaping products to +18-year-olds in specialist tobacco stores, poses a challenge to convenience retailers that will no longer be able to stock these products. We predict that this will wipe out approximately $20MM of sales as a result of flavoured vapes being taken off the shelf and the corresponding decline in sales of primary units and accessories.

Performance is relatively flat outside of tobacco with some notable exceptions in certain categories – namely with products that have capitalised on consumers’ move to shop more locally.

Post-pandemic purchasing

While the channel saw a sharp decline in sales following the March 2020 lockdown, shop sales recovered as the nation moved to Level Two movement restrictions. The categories that performed well since the rise of the pandemic have continued to perform well. These categories include bread, tobacco and vaping, gift cards and technology accessories, or categories purchased during planned missions by consumers shifting their purchasing by shopping locally. The categories that initially suffered during lockdown but have since bounced back are impulse categories that rely on in-store foot traffic like ice cream, beverages, snackfoods, and confectionery.

Winners, watchouts, and where to look for growth

We’re already seeing some signals for growth among certain products. Gift cards continue to grow, with more than $10MM in year-on-year growth. Beverages are growing by $4MM with notable new sugar free products driving the majority of this growth. In the last year, four of the top 10 new product developments in the beverage category were worth over $1.2MM combined in the first three months following their launch. Technology accessories continue to perform well, growing by $1MM vs year ago. Ice cream, driven by both take-home and single product sales, is also growing by $800k vs year ago.

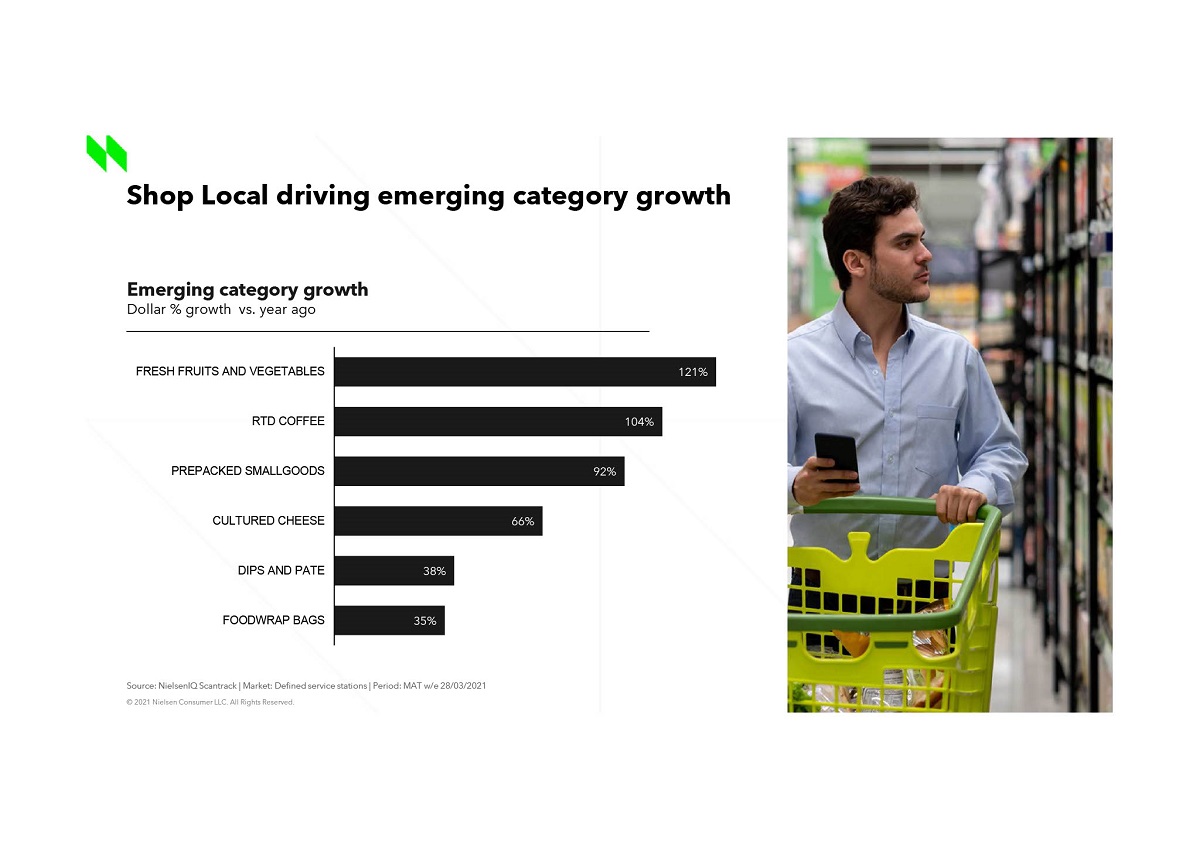

Emerging categories – those delivering high percentage growth year on year – include fresh fruit and vegetables, RTD coffee, delicatessen, cultured cheese, dips and pâté as local shoppers pick up convenient entertaining options. While still forming a low proportion of overall channel sales, these categories are growing at a rate of 60%-120% year on year and are good candidates for further category development.

In summary

New Zealand’s consumer dynamics continue to shift as consumers ‘shop local’, move their grocery spending online, and as out-of-home spending is substituted by in-home consumption solutions – particularly among financially constrained consumers. The convenience channel is well placed to take advantage of these shop local trends in particular with some retailers reinventing store formats to cater for these new shopper missions, offering fresh and quality meal products like hot chickens, and delicatessen goods for easy assembly at home.

While it’s necessary to continue developing store formats that are finding success in other areas around the globe, these developments need to always consider New Zealand’s unique geography and population. For now, the opportunities for the convenience channel are best realised with local consumers, those who are changing their day-to-day shopping habits, and servicing the impulse and on-the-go needs of Kiwis travelling within the country.

*Channel defined as Service Stations Organised plus Tier 2, Data to 28th March 2021