While the world appears to be in a deflationary environment, it is no secret that Asia Pacific is set to drive global fast-moving consumer goods (FMCG) growth. After all, approximately half of the world’s middle class population resides in Asia.

Much of the continent’s growth has been attributed to the booming economies of China and the Four Asian Dragons of Japan, Korea, Taiwan and Singapore. Looking ahead, however, it appears that Southeast Asia’s Tiger Cub Economies of Indonesia, Malaysia, the Philippines, Thailand and Vietnam are shaping up to become Asia’s next growth frontier.

READY TO ROAR

While Southeast Asia accounts for just 2.6% of global land area, it is home to 8.3% of the world’s population—and its population is growing faster than the population of the U.S. States, China and the U.K.

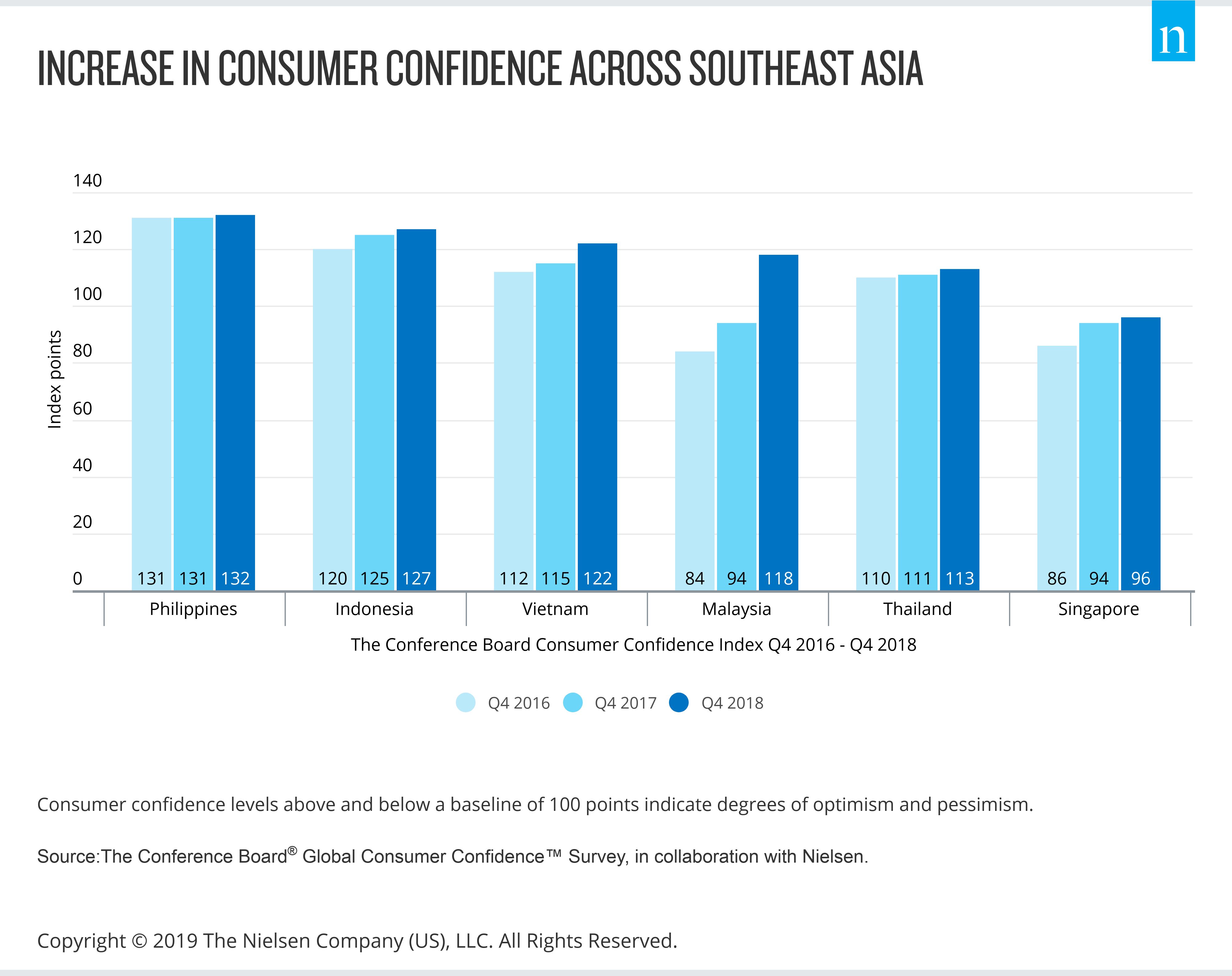

Over the past four years, Indonesia, Malaysia, the Philippines, Singapore, Thailand and Vietnam have all seen stable GDP growth. Consumer confidence in the region has also increased across the board, with material improvements in optimism levels in Malaysia, Singapore and Vietnam.

As household incomes in the region have grown, so has consumers’ perception on their financial wellbeing. On average, 72% of Southeast Asians believe that they are financially better off than they were five years ago, with consumers in the developing economies of Vietnam, Indonesia and the Philippines demonstrating the most positivity in this aspect.

Spending power, too, is on the rise, with one in two consumers saying that they live comfortably and are able to buy some things because they want to, while one-fifth say they spend freely.

CONVENIENCE IS KEY

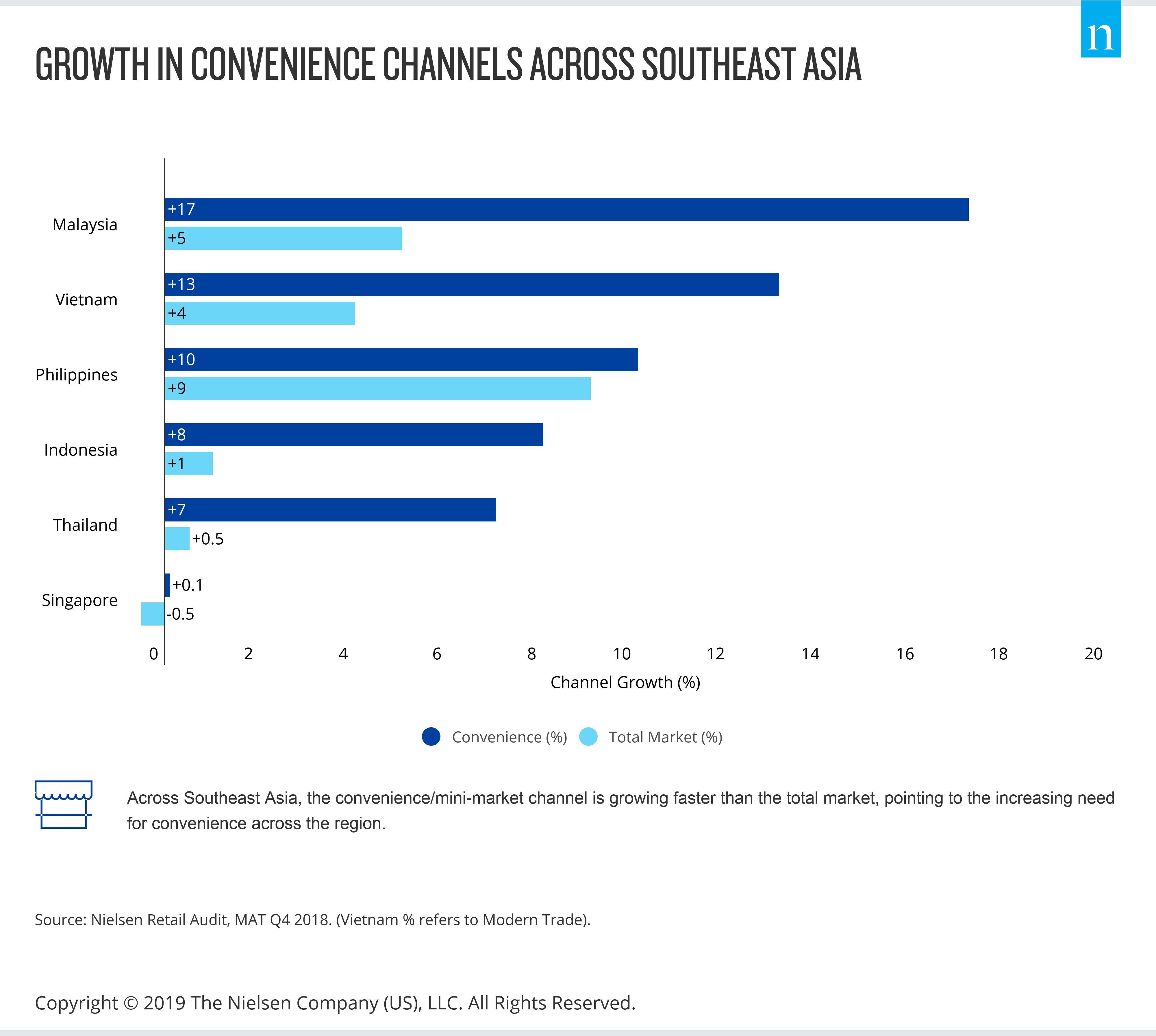

The region’s relatively young population—the majority of whom are under the age of 35, as well as high digital connectivity, has spurred the need for convenience, which has in-turn led to the desire for more innovation in retail.

For example, we see the proliferation of smaller-format stores in countries such as Vietnam, Indonesia and Malaysia, while e-commerce is gaining traction in connected markets such as Singapore, the Philippines and Malaysia.

All these positive indicators point towards the immense opportunity for growth in the region, which currently remains untapped. However, there is no one-size-fits-all strategy to win, as each country has its own unique characteristics that set them apart from each other.

Nielsen’s What’s Next In Southeast Asia report takes a deep dive into the local drivers for each market, and highlights the key commonalities and differences between the countries.

https://www.nielsen.com/apac/en/insights/report/2019/whats-next-in-southeast-asia/

Source: Nielsen