The NZ Association of Convenience stores (NZACS) hosted its annual state of the industry report recently via a webinar, compiled by Nielsen research.

Hosted by Dave Hooker of NZACS and presented by Lance Dobson and Nicola Voice from Nielsen, the report focussed on the international and local impact of COVID-19, plus the resulting impact on consumers and the convenience retail sector.

Global outlook & local outlook

The headlines included:

- Recessionary shocks

- Immediate sharp economic contraction – NZ moves from 2.2% growth to -3.5%

- Travel & tourism GDP plummets at a rate of five times the impact of the 2008/9 global financial crisis – an estimated hit of $2.7 Trillion to the global industry

- Some industries crippled, frozen or closed

- Unemployment globally forecast to take decades to recover with a possible second wave hit resulting in diminished wealth and stunted spending

- Sharpest plunge in consumer confidence in the last 15 years

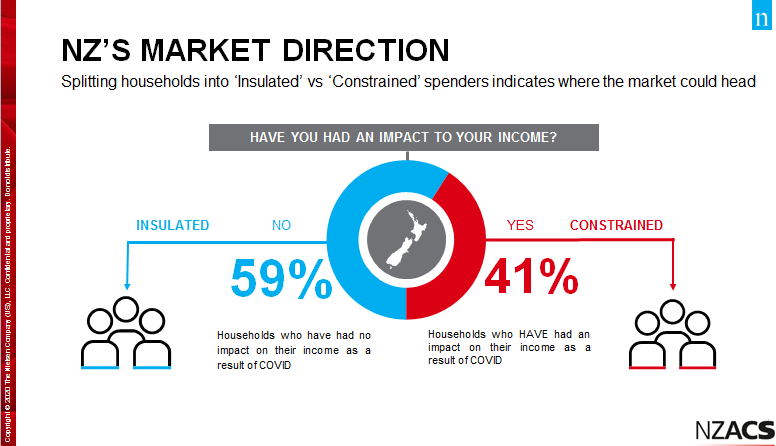

The situation results in “A tale of two shoppers” – insulated versus constrained consumers.

During lockdown our shopping behaviours changed to:

LOCAL & CONVENIENT: 16% of New Zealanders shopped at local dairies and convenience stores more frequently.

Constrained shoppers are even more likely to shop locally (18%).

Four Square also benefitted with 11% of all respondents visiting more often.

ONLINE: COVID-19 accelerated technology adoption for NZ households – 23% of us purchased groceries online during lockdown. However, only 49% of those households have continued to shop online post lock-down.

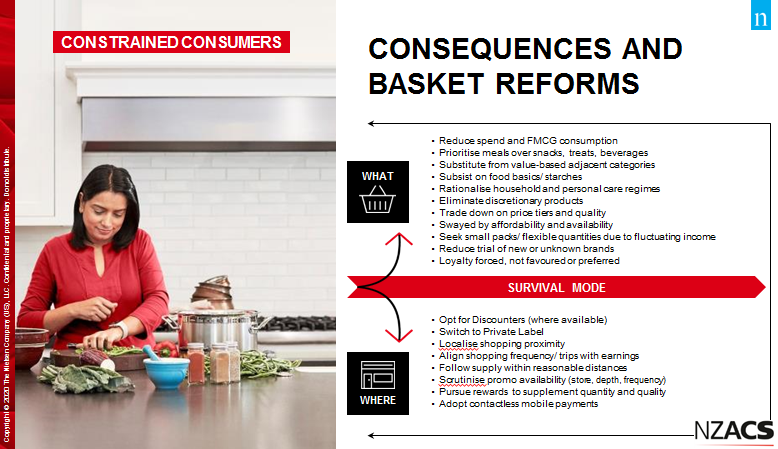

So, for the most affected, constrained shopper what does the behaviour look like?

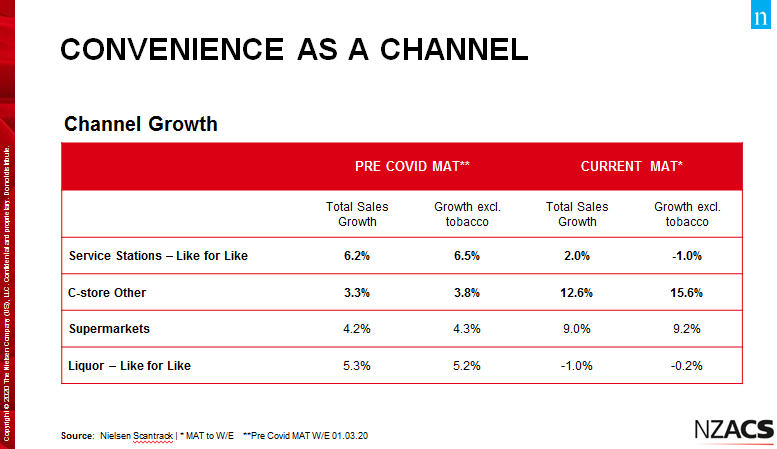

Impact on channels

Supermarkets made obvious gains during lockdowns, however other Convenience stores did well due to greater social distancing and overall convenience.

Service station shops and liquor shops were constrained through the periods due to partial or total closure.

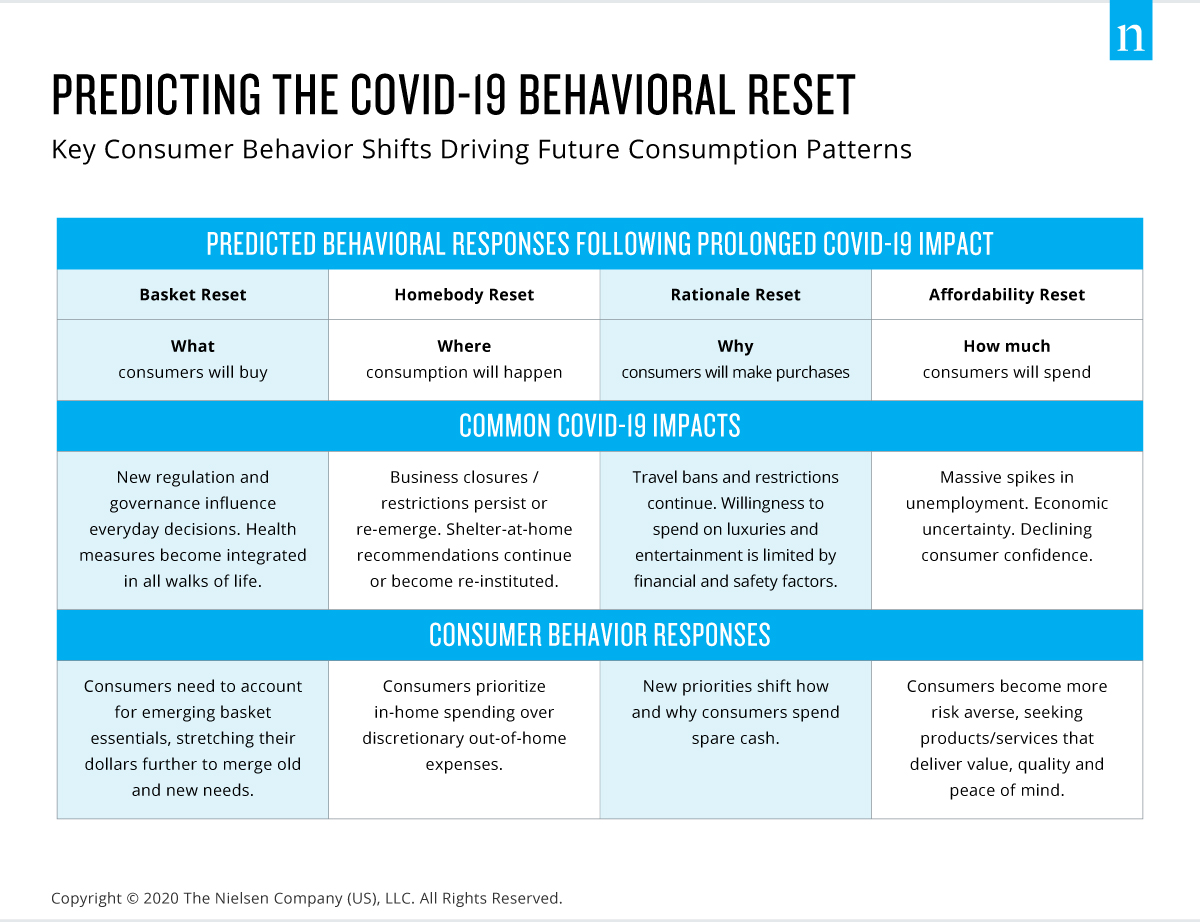

According to Nielsen, unemployment is at the heart of long term consumer change. At its core, this means that consumers will reset their behaviour based on their financial ability. Here are just four of the resets Nielsen are predicting.