Foodstuffs North Island (FSNI) has provided an update on progress against its action plan to deliver better outcomes for New Zealand consumers.

In response to the Commerce Commission’s draft report on its market study into the retail grocery sector, FSNI committed to a comprehensive Action Plan to remove the barriers to market entry that are within its control and deliver better competition and value for New Zealanders.

Chief Executive Chris Quin says while the ongoing challenges of the COVID-19 pandemic have prevented FSNI from progressing some of the actions with the pace that it intended, particularly through the Omicron outbreak, it continues to progress each of the steps in its action plan.

“Despite this being a challenging time for New Zealanders and our business, this work continues to be a priority for us and we are getting on with implementing our action plan.

“On competition, we have not been including or accepting the inclusion of restrictive covenants or lease exclusivity provisions for new property transactions, and we are progressing with the removal of existing restrictive covenants – and we have already released covenants from approximately 30 titles.

“On pricing and promotions, we are on track and working closely with our New World and PAK’nSAVE teams to manage the transition to a reduced number of pricing ticket types and more clarity on promotions.

“We have also outlined to the Commission our proposed enhancements to our loyalty terms and conditions and expect to be able to quickly implement these, to the extent they remain appropriate after the final report and Government response.

“We support a mandatory grocery code of conduct and have engaged with the Commission to emphasise the importance of industry participation in its development. We’ve also been looking across a sample of our stores with the principles of the Australian Code in mind to see how we currently compare.”

Quin says FSNI’s action plan addresses all the proven issues that have been raised during the market study process.

“Throughout the market study process, we’ve listened and fully engaged, we’ve outlined the steps needed to move the dial in the areas that we have control over, and we’ve committed to ongoing work that will make a meaningful difference to customers.

“We have been clear from the outset that we welcome competition, but we don’t believe there is credible basis for recommendations beyond those we have indicated support for in our action plan.

“There has been no evidence produced to support the more extreme options being proposed, nor that they would deliver better outcomes. It’s important to recognise that options that involve forced divestment or forced structural separation of existing market participants would be unprecedented in our economic history.

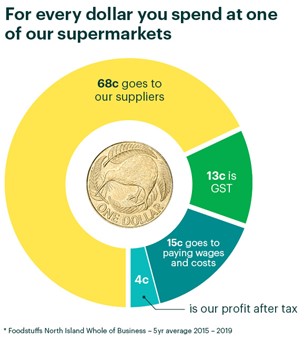

“By just focusing on supermarkets, this market study into the retail grocery sector has only looked at what makes up 19c of every dollar on shelf. Within the 19c we are responsible for, we are doing everything we can to deliver value for customers.

“The evidence is clear that the market is in better shape than claimed by some. Our profits are not consistently high when compared to the Commission’s international sample of grocery retailers, we have good supplier relationships, and the industry innovates, invests and delivers for New Zealand consumers. This is not a simple duopoly; competition is growing right now and will continue to grow.

“At the end of the day, the key question the final report needs to credibly answer is how we can best get more value and more sustained competition for New Zealanders.

“This can be achieved through our action plan, but there is also work to be done on the Government side to reduce barriers to competition, including making appropriate changes to the RMA and the overseas investment regime to better encourage and facilitate new entry into New Zealand.

“We look forward to seeing the final report and engaging with the Government on its policy response.”