By Julie Bramley, Market Insights & Research Consultant, Circana, NZ

Alistair Leathwood, Head of Media Analytics, Circana ANZ

Last week, some of New Zealand’s most prominent consumer packaged goods companies gathered for an exclusive event hosted by the Circana team. The sharpest minds in the business discussed the latest trends, issues and challenges facing our industry. The over-arching theme of the evening was resilience – the importance of maintaining agility, efficiency and effectiveness in a fast-moving environment. The packaged goods sector has faced incredible challenges over the past few years, from the pandemic; through supply chain shocks, labour shortages and floods; to an unprecedented increase in cost of goods. Despite this, manufacturers have continued to deliver the exceptional quality that keeps New Zealand produce in demand all over the world, whilst innovating with new flavours, formats and products.

Shoppers spend more at supermarkets amid tough economic conditions

With ongoing inflation and rising living costs, Kiwis are spending more at the supermarket than ever before. However, the increased spending is not purely due to high prices – shoppers are also buying more products. Food and beverages are driving unit growth in New Zealand – in contrast to many other international markets, where volumes have declined. We have seen a shift in dining behaviour as cost-of-living pressures have driven a decrease in out-of-home spending and an increase in home cooking. There has always been a strong inverse correlation between hospitality and grocery volumes: as one grows, the other shrinks. It’s no surprise, therefore, that supermarkets are experiencing record sales. In the fiscal year ending March 24, 2024, Kiwis spent $18.4 billion in-store, a new annual high. Nearly all food and beverage-related departments are in growth, with the sole exception of alcohol (driven by changing behaviours around liquor consumption).

The resurgence of the centre-store

The store’s centre aisles (Cooking, Baking, and Grocery departments) are currently driving one out of every five dollars of growth as customers seek cost savings and ways to enhance their family meals. This 22% share of growth, is comparable to the levels of 2009 and the GFC, when the centre-store tipped 28% of total supermarket growth. Home cooking ingredients are at the heart of this, particularly Indian and Mexican foods, dried pasta, and herbs and spices – which all experienced unit growth of more than 8%. Combined, shelf-stable departments are growing twice as fast as chilled fresh department in unit growth.

Private Label in growth mode

Private Label, which accounts for 14% share of total prepackaged grocery spend, has been outperforming branded at a total level since 2022 (when Private Label was plagued by supply issues). Seven in thirteen departments (excluding tobacco and general merchandise) have private label products that make up more than 10% of the total value. Within those seven departments (Baby, Bakery, Cooking & Baking, Dairy, Frozen, Grocery and Paper Products) private label accounts for 29% of overall value growth, compared to 18% overall.

New Products are working harder

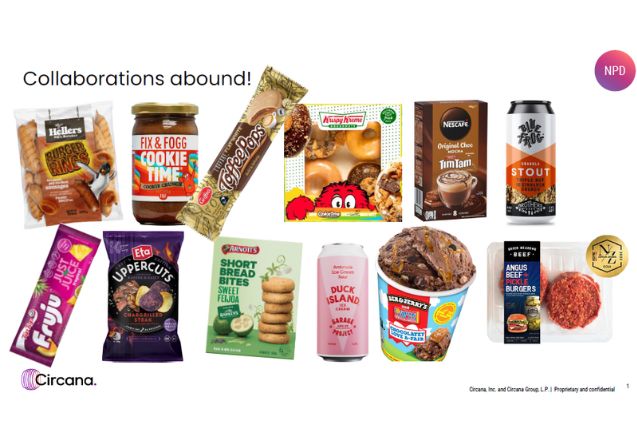

New Zealand FMCG manufacturers have continued to innovate, despite the challenging conditions. While the number of new product launches is down 18% from the previous year, sales of new products have performed better, increasing 12.2% in value and 7.4% in unit sales. Collaboration is a clear theme: more than $3 million in sales have been generated by manufacturers working together through a variety of successful collaborations and cross-promotions. Hellers and Bluebird went all-in with a mash-up of sausages and Burger Rings; Cookie Time paired up with Fix & Fogg to make a Cookie Time spread, and Cookie Time flavoured donuts were made with Krispy Kremes. L’affare paired with toffee pops to create an espresso flavoured toffee pop, cleverly named Flat Whites (as opposed to our personal preference -Coffee Toffee Pops!) TimTams continued their run of taste collaborations, getting together with Nescafe to create an indulgent mocha drink. These are just a few of the imaginative partnerships that are winning with consumers as they seek novelty and affordable indulgences amid restrained overall retail spending.

The road ahead

Despite some signs of disinflation, consumers and businesses alike will face another difficult year as pressures on household budgets remain high. The overall retail market is soft, and the most recent forecasts indicate that Official Cash Rate (OCR) will not fall until at least the end of the year, bringing with it the promise of lower mortgage payments. On the positive side, annual food price inflation has slowed to 0.7% in the most recent March 2024 figures. In addition, the continued squeeze on out-of-home food spending and declining volumes should lead to supermarkets remaining as the channel of choice. Retailers and manufacturers can capitalise on shoppers’ desire to find value, seek new ways to spice up their meals, create ‘fakeaways’ at home and look for opportunities to treat themselves with affordable indulgences.