Data on consumer spending processed through Worldline NZ’s payments network in June show Kiwi retailers continued to face tough trading conditions as winter began, although the trend did not worsen during the month.

Consumer spending in June 2023 through all Core Retail merchants (excluding Hospitality) in Worldline NZ’s payments network reached $2.908B, which is up 5.3% on June 2022, and up 18.9% on the same month in 2019.

Worldline NZ’s Chief Sales Officer, Bruce Proffit, says these numbers show spending patterns have not changed much in the last few weeks compared to the previous month, although pockets of higher spending activity were evident in Whanganui and Otago.

“Spending on non-food items, in aggregate, remains below that of 12 months ago while food spending is running higher throughout the nation,” says Proffit.

Worldline’s numbers show spending through Food and Liquor stores in June was up 9.4% on the same month last year and down 0.9% amongst the remaining non-food Core Retail merchants (excluding Hospitality).

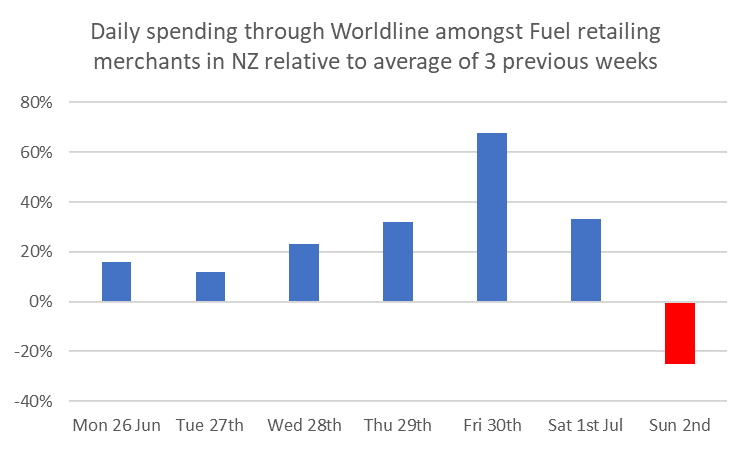

Unsurprisingly, the most noticeable change within the month was the surge in spending at Fuel retailing merchants ahead of the 1 July removal of the fuel temporary excise duty reduction. This spending, which includes fuel and other items, jumped 24% in the week ending Friday 30 June from the previous three-week average, with the largest spike on Friday.

“Transactions processed on Saturday, 1 July, were also above average but the Saturday total includes some Friday spending processed early Saturday morning,” says Proffit.

Figure 1: Daily All Cards NZ underlying* spending through Worldline Fuel Retailing merchants for 26-Jun-2023 to 2-Jul-2023 relative to the daily average in the preceding 3 weeks (* Underlying excludes large clients moving to or from Worldline)

Around the regions, the highest annual growth rate was recorded by Core Retail merchants (excluding Hospitality) in Whanganui (+11.2%). Noticeably, this was up across a range of merchants in the region, including clothing stores, pharmacies, and supermarkets, as well as Hospitality merchants and – beyond Core Retail – amongst beauty and hairdressing salons.

The lowest growth rate was in Wellington (3.4%), although other large centres, such as Canterbury (+4.7%) and Auckland/Northland (+5.5%), did not fare much better.

Gisborne’s annual spending growth (+5.7%) was slightly above the national average but this statistic conceals underlying challenges such as the sharply lower spending on the days of the storms and an 8.2% annual decline amongst Hospitality merchants for the month.

| WORLDLINE All Cards underlying* spending for CORE RETAIL less HOSPITALITY merchants for June 2023 | |||

| Value | Underlying* | Underlying* | |

| Region | transactions $millions | Annual % change on 2022 | Annual % change on 2019 |

| Auckland/Northland | 1,075 | 5.5% | 14.5% |

| Waikato | 237 | 7.7% | 28.0% |

| BOP | 197 | 5.3% | 24.4% |

| Gisborne | 26 | 5.7% | 18.2% |

| Taranaki | 68 | 5.1% | 33.0% |

| Hawke’s Bay | 105 | 7.9% | 29.8% |

| Whanganui | 39 | 11.2% | 37.4% |

| Palmerston North | 91 | 10.0% | 31.2% |

| Wairarapa | 36 | 4.7% | 31.9% |

| Wellington | 278 | 3.4% | 12.2% |

| Nelson | 57 | 8.8% | 21.7% |

| Marlborough | 35 | 9.5% | 26.2% |

| West Coast | 20 | 8.2% | 31.4% |

| Canterbury | 350 | 4.7% | 24.4% |

| South Canterbury | 51 | 10.2% | 32.4% |

| Otago | 155 | 9.9% | 22.1% |

| Southland | 67 | 8.2% | 22.5% |

| New Zealand | 2,908 | 5.3% | 18.9% |

Figure 2: All Cards NZ underlying* spending through Worldline in June 2023 for Core Retail (excluding Hospitality) merchants

(* Underlying excludes large clients moving to or from Worldline)

ABOUT WORLDLINE IN NEW ZEALAND

We are New Zealand’s leading payments innovator. We design, build and deliver payment solutions that help Kiwi business succeed. Whether you’re looking for in store, online or mobile payment solutions or powerful business insights, Worldline is here to help with technology backed by experience.

About Worldline (GLOBAL)

Worldline [Euronext: WLN] helps businesses of all shapes and sizes to accelerate their growth journey – quickly, simply, and securely. With advanced payments technology, local expertise and solutions customised for hundreds of markets and industries, Worldline powers the growth of over one million businesses around the world. Worldline generated a 4.4 billion euros revenue in 2022. www.worldline.com