By Joanna Parman, Nielsen

What defines a snack? A treat between meals, something to curb your hunger, or even replace breakfast? However you see it, for most people snacking is a daily habit.

For years, confectionery, crisps and soft drinks were the most popular go-to snack choices for the British consumer. But over the last five years, we’ve seen a dramatic shift in the world of snacking. Now, thanks to the wider social trends towards healthier living and changing preferences towards sugar and protein consumption, shoppers have more choice than ever when it comes to their mid-day snack.

To understand the scale and opportunities within snacking, we need to redefine the category. We need to think beyond the traditional core that delivers the bulk of demand today and look at the secondary options to understand what feeds into the core segment of snacking and what sits on the perimeter. This will help to better understand where your competition comes from, where your growth opportunities are, and what role your brands play today and in the future.

CORE VS PERIMETER

The snacking category is currently worth over £18 billion, and growing at 0.3% in value. It’s an enormous category and an integral part of the store that drives basket spend. The core is made up of categories traditionally associated with snacking:

Savoury snacks (crisps, popcorn, nuts, breaded snacks, savoury biscuits)

Sweet snacks (confectionery, sweet biscuits)

Snack bars

Soft drinks (water, cola, energy drinks, squash)

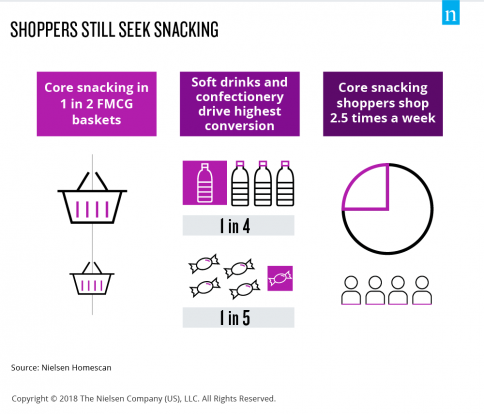

Today, one in two baskets contain a soft drink product, and one in three contain confectionery – a strong message to retailers that despite all of the news surrounding sugar and a growing focus on healthier lifestyles, shoppers still want indulgent snacking products.

But beyond this sits a wide perimeter of snacking products seeking to fulfil the next snacking occasion and tempt shoppers outside of the core. More often than not, these are products whose primary function sits entirely outside of snacking. For example, most food and drink categories in the store now offer a “snacking” option: cereals transformed into on-the-go bars, spreads transformed into snack packs, yoghurts in the chiller, and snack-sized portions of packaged fruit and vegetables in the produce area.

This is where the innovation lies and it’s this perimeter that will ultimately shape the future core of the snacking category.

SCALE AND BIG CONSUMER TRENDS

Products that sit in the perimeter must continuously look outside of the store to the wider food and drinks market to spot trends early, and promote continuous development of more experiential, convenient and innovative propositions.

Health is one of those trends currently driving innovation in the snacking category with 41% of U.K. shoppers looking for snacks that contain less sugar.

There are several levers brands can pull to help them meet this healthy snacking occasion such as recipe changes or enhancement. In our global snacking survey we found that over a quarter of shoppers were looking for snacks with natural flavours and colourings. This trend is only set to grow, so creating a recipe based around natural components will set the product on the right track into the core.

Reducing the product size or portion is also an option for many manufacturers to help manage sugar content in products. The Nielsen Sugar Tax survey shows that the U.K. is largely accepting (65%) of this practise, particularly younger shoppers (74%). But it’s imperative not to fall into the “shrinkflation hole”, as two thirds of these willing shoppers are averse to paying a premium for a smaller pack.

Despite this, shoppers still spend in their droves on sugary, salty, fatty treats. By embracing the occasion, brands can deliver a proposition that ensures treat and functional snacking products that serve multiple needs and will help protect the core snacking categories of today into the future.

To find out more, download the full Nielsen report here .